The Gambling Phenomenon of Junk Stocks with Low Price in the A-share Market

2017' Teamwork of “Data analysis and entrepreneurial decisions”

Professor Jianfeng Yu

I、Introduction of the Phenomenon

In the A-share market, low-priced stocks have long been the focus of attention of the majority of small and medium investors. Hu (2014) and Yu (2015) believe that investors prefer low-priced stocks, mainly because they believe that low-priced stocks are more likely to be undervalued, and thus they can bring sustained excess returns, even after adjusting for liquidity premiums. Que et al. (2015) found that if you continue to buy low-priced stocks, you will get 6 times higher than the market index in 1995-2015 in A-share market. Accordingly, he believes that due to the low absolute price of low-priced stocks and many possible M&A topics, there is ample room for recovery in stock price, thereby achieving huge excess returns.

Among the low-priced stocks, there is also a class of stocks that is particularly attractive, and this is the specially processed stock, which is usually named as ST stocks. The so-called ST stocks refer to the fact that when the listed companies have abnormal financial status or other conditions, leading the company's prospects difficult to judge, which may under mine the rights and interests of investors, the Exchange will implement special treatment of the company's stock trading, and add "ST" before the stock abbreviation. The special trading stocks are limited to a 5% increase or decrease in trading days, and the interim report must be audited. The ST system of the A-share market has been undergoing a series of evolution and improvement since its birth in 1998. Taking the whole listed companies in 2017 as an example, out of the 3614 listed companies in A-shares, 144 stocks were handled by ST, which accounted for 3.98% of the total number of listed companies. It can be seen that while ST shares account for relatively small amounts, they have become an important part of the A-share market and they are investors' investment targets and elements that cannot be ignored.

Moreover, another important reason why ST stocks are taken by a large number of investors seriously is that although ST stocks are a symbol of bad stocks with poor A-share market performance, they can bring high excess returns. Wang (2012) found that ST stocks can generally obtain excess returns, which differ greatly among different subsamples. Further analysis found that as set reorganization is the biggest driver of ST stocks’ excess returns, and the duration of the special treatment and listing location also have quite significant effects on the company's excess returns.

Examples

Example 1) AVIC(AVIC Shenyang Aircraft Company Ltd.)

Take AVIC (stock code: 600760.SH) as an example. The company, whose original name is "China Aviation Black Panther", suffered a loss for two consecutive years in 2014 and 2015, which led to the special treatment of the delisting risk warning implemented by the Shanghai Stock Exchange. On May 5, 2016, this company was officially capped and it sticker became the ST black panther. As can be seen in Figure 1, from March 29,2016, when the CNAF Panther issued its third announcement to warn the risk that the company's stock would be delisted, the company's stock price fell from ¥13.50 to ¥7.70, a drop of up to 43%.

Figure1 The Stock Price Before and After AVIC was Special Treatment

However, on August 29, 2016, the company began to suspend trading due to major assetre structuring. The company resumed its stocks trading until December 13, 2016,when it issued an announcement about major asset reorganization and related party transactions. Right after the resumption of trading, the company's stock price experienced a consecutive 18 increasing limit (one increasing limit for ST stocks means a 5% increase in stock price), the stock price surged from ¥9.74 before the suspension to the highest point ¥42.60, a dramatic increase of up to 337.37% (see Figure 2). On March 13,2017, the company delisted risk warning was withdrawn and the stock abbreviation was also restored from the "ST Black Panther" to the " China Aviation Black Panther".

Figure2 The Stock Price of ST Black Panther After Its Resumption

Example 2) LeTV(Leshi Internet Information and Technology Corp.)

Another extreme example is LeTV (stock code: 300104.SZ). It is because of Jia Yueting that LeTV can spring up and break up so abruptly. On May 13, 2015, the stock price of LeTV reached a record high point of ¥44.70, leading its market value of circulation exceeded 80 billion yuan. However, in the second half of 2017, due to Jia Yueting's absconding with money etc., LeTV has suffered huge losses with a net loss of 13.8 billion yuan. On January 24, 2018, the company's shares resumed trading and experienced 10 consecutive down limit boards and its price plummeted from ¥15.52 before the suspension to a minimum of ¥4.01 (see Figure 3), which was a drop of more than 70%, and the circulation market value was also sharply reduced to 13.1 billion yuan.

At the beginning of 2018, Sun Hongbin, chairman of SUNAC China, invested RMB 15 billion in LeTV. However, he was still unable to make any remediation. At present, LeTV is still faced with difficulties and difficulties, and it is difficult to improve in a short time.

Figure3 The Stock Price of LeTV After Its Resumption

Ⅱ、 Predictions from the classical theory or the efficient market hypothesis

The above two diametrically opposed cases vividly demonstrated the two major characteristics of low-priced junk stocks. First, low-priced junk stocks have the possibilities to obtain ultra-high yields; second, these cheap junk stocks have the similarities with the call options which have risks hedged and limited potential losses.

However, the high-yield and low-risk coexistence of low-priced junk stocks is contrary to the classic financial theory and effective market hypothesis. First of all, the core of classical financial theory is the matching of risk and return, which means low risks lead to low return while high risks result in high return. Once this equilibrium relationship is violated, there may be wrong pricing of risk in the market, leading to the emergence of arbitrage opportunities. Based on the actual performance of these junk stocks, investment in these low-priced junk stocks is somewhat similar to the purchase of call options. The downside risk is limited, but it may result in high excess returns, which violates the basic market equilibrium relationship and effective market hypothesis.

Second, from the perspective of stock fundamentals. Low-cost junk stocks are often poorly managed stocks with continuous loss of performance, small market value, and relatively unobstructed information mining. Therefore, the risk of investing in these stocks is relatively high, especially when liquidity risks and delisted risks are taken into account. The company’s reorganization of assets in the future is a very uncertain event, and therefore it is not enough to become a sound reason to invest in these stocks. However, most of these junk stocks will enter a sideways mode after they have gone through a wave of sharp decline. Under the circumstance that there has been no obvious improvement in fundamentals, the risk of downside has fallen. A dramatic reduction in risks is also a violation of the effective market hypothesis.

Therefore, in the developed capital market, according to the classical theory or the effective market hypothesis, investing in these low-cost junk stocks should be a very risky investment, so its possible high earnings are also a reasonable compensation for the high risks. However, in the A-share market, the high-yield and low-risk coexistence of low-cost junk stocks is against the classical theory, and can therefore be considered as the product of the defects in the A-share market system.

Ⅲ、Explanations for why such a phenomenon exists

Due to the late start of the A-share market and the incomplete laws and regulations, there are still some institutional defects, which receive extensive criticism. These defects are mainly reflected as the strict listing approval system of the A-share market and the loose delisting system.

First of all, the overly stringent listing approval system has caused the excessive demand of "shell resources" in A-share market to endure. As the majority of private enterprises in China, which are unable to obtain sufficient bank credit and other financial services, the stock market is extremely attractive to private enterprises that rely heavily on bank credit. However, due to a series of rigid requirements for the financial indicators and the approval rate of the Securities Regulatory Commission, it is very difficult for private enter prises to be listed quickly. For example, one of the important reasons why a large number of Internet companies in China choose to go to the United States or Hong Kong for listing, rather than choosing to list in A-share market, is that start-up technology companies are often unable to meet the profit requirements of A-share and thus are ineligible to be listed. At the same time, some A-share companies have suffered net losses and lost their core assets due to poor operation and management, and therefore become "shell companies". In this case, a unlisted company can purchase a shell company and inject its own assets into listed companies and complete the actual control of listed companies, and then become a listed company. Because a large number of private enter prises are difficult to list through IPOs, "backdoor listing" has become a common phenomenon, which in turn leads to huge demand for "shell resources". Consequently, the price of "shell resources" has been rising all the way. A listed company with a dismal operation may be due to being “backdoored” and the stock price will rise several times.

Second, due to the loose delisting system, listed companies face a very small risk of delisting. For example, a listed company that meets three consecutive years of net losses will start compulsory delisting procedures. However, listed companies can easily resolve the delisting crisis. The A-share market have grown since 1990, and the number of listed companies has exceeded 3,600. However, the total number of listed company delisting cases has been less than 100, accounting for less than 3%. Therefore, a poorly-operated listed company in China can maintain in the edge of delisting for many years, thus retaining its valuable shell resources until purchased by a suitable unlisted company, with the original holder can make a big fortune in the with drawal. Therefore, Chinese listed companies have strong incentives for earnings management. As a result, even if the "unfortunate" buying of junk stocks in A-share market, whose business have no prospect, the risk of being delisted is far less than in the United States, Hong Kong stock market. In this context, the possibility of a sharp drop in the stock price of the junk stocks in the Chinese stock market due to the risk of delisting will be much less than that of the US stock market and the Hong Kong stock market.

The coexistence of high-yield and low-risk of the low-priced junk stocks are closely related to the above-mentioned defects in the A-share market system. The high return of the junk stock origins from the large appreciation of the stocks that the“shell resource” may bring. Once the company’s stock is successfully restructured or reverse merged, it will cause the company’s share price to soar, resulting in high profits. CNAC Panthers This is an example. The low risk of the junk stocks lies in that if the stocks of the company are bought at a very low point, the stock price can not fall further, and the value of "shell resources" has roughly established the lower limit of the company’s market value. It is similar to the long-term depreciation of call options. Taking LeTV as an example, after LeTV fell to a historical low of ¥4.01 on February 14, 2018, it has never fallen below this lower limit, and has experienced several daily increasing limits, reaching a maximum of ¥6.77.

In addition, the uniqueness of Chinese investor structure is also an important reason for the emergence of irrational phenomena in low-cost junk stocks. Since nearly 70% of investors in the A-share market are individual investors, compared to professional institutional investors, individual investors often do not have the ability to conduct professional fundamental analysis, but instead use more technical analysis and follow-up feelings. At the same time, due to traditional culture and other factors, Chinese investors have a natural and simple dialectical thinking. Under the circumstances that the risk of delisting of waste stocks is controllable and there are few delisting cases, they naturally believe in the investment concept of "a recover follows a long-lasting fall". Consequently, these low-cost junk stocks that have experienced sharp declines are definitely satisfy this feature, thus favored by many individual investors.

Ⅳ、Investment Strategy

This research focuses on low-priced junk stocks, so the investment strategy will select the stocks of the worst performers in the market to build asset portfolios. Based on the stock-related financial indicators and market performance, this strategy will determine investment targets and empirically demonstrate the effectiveness of the strategy.

Based on a number of financial indicators and transaction data, a portfolio of assets is constructed by using multiple rankings. First, according to the trading volume, all the stocks of the same day will be divided into X groups, and further according to the EPS, each grouped by trading volume will be grouped into Y group, and further divided into Z groups according to the stock price by the transaction volume and the EPS sorting group. That is, all stocks on the day would be divided into X × Y × Z groups. In these groups, the stock portfolio that has the worst performance of each indicator is selected as the investment in dicator. The target portfolio would be updated and adjusted once a week.

As investment targets are low-cost junk stocks and junk stocks are the focus of irregular transactions such as suspension of trading and delisting, it is necessary to deal with these special cases. When renewing a stock portfolio, the suspended stock must not be sold, the amount involved is frozen, and the old stock is sold at the closing price based on the remaining stocks in the portfolio and new stock is bought. Delisting stocks also can not be sold and have been held so far, which involves the freezing of funds. A conservative treatment is also applied to transaction costs to ensure that the stock portfolio's yield is not overestimated. Assume that when the stock portfolio is updated, sell all the old stocks other than suspension and delisting, calculate the selling transaction fees, and then buy new stocks to calculate the buy transaction fees.

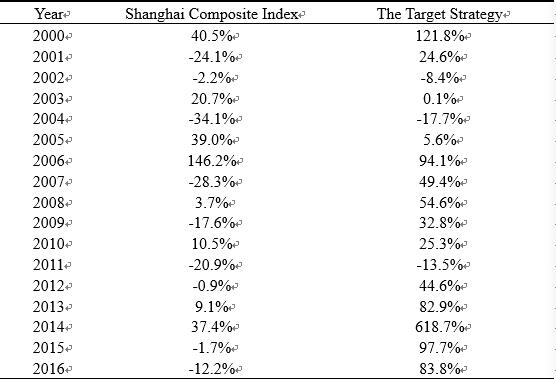

Market portfolio adopts buy-and-hold strategy. By comparing the performance of target asset portfolios and market portfolio, the effectiveness of the strategy was verified. The results are shown in the Figure 4 and Table 1.

Figure4 Performance of target portfolio and market portfolio

Table1 Performance of target portfolio and market portfolio

In conclusion, investing in the portfolio of low-priced junk stocks in the A-share market can indeed achieve sustained excess returns, but given the small size of the market value and poor liquidity of these underlying stocks, once a substantial purchase leads to a sharp increase in the cost of open positions, the effectiveness of this strategy remains to be further verified.