There are many types of investments. Most of them belong in the primary and secondary market category regardless of their underlying asset type. The different types of investment or instrument are usually originated from an entity or a certain project, and thus may be associated with the different stages of life that a company is in. Startup companies may have different types of funding rounds available. Most start with what is known as "seed" funding or angel investor funding at the outset. Next, these funding rounds can be followed by Series A, B, and C funding rounds, as well as additional efforts to earn capital as well, if appropriate. Before long, the company has risen through the ranks of its competitors to become highly valued, opening the possibilities for future expansion to include further equity financing such as an IPO.[1] Between these stages, they can also establish debt financing. In return for lending the money, the individuals or institutions become creditors and receive a promise that the principal and interest on the debt will be repaid on a regular schedule.[2] When companies mature, they will rely more on Debt Financing. There are also other alternative investments such as Currencies, Commodities and etc.

The rule of thumb throughout the investment space: Risk is proportional to return. Relating to the types of investment above, the earlier stages of funding/equity types of the investments bare a higher risk and more volatility in returns against the debt instruments which have a relative lower risk and more stability in returns.

The different instruments listed below are sorted in order of seniority: secured debts, unsecured senior debts, unsecured subordinate debts, junior subordinate debt, AT1/preferred shares, commonstocks.

The thing to consider is the relative investment value based on the types of investment one were to choose. In the investment space, some measure by absolute investment return and others measure by relative investment return as a benchmark. Given such cases, even negative return investments can be considered as well performed investments.

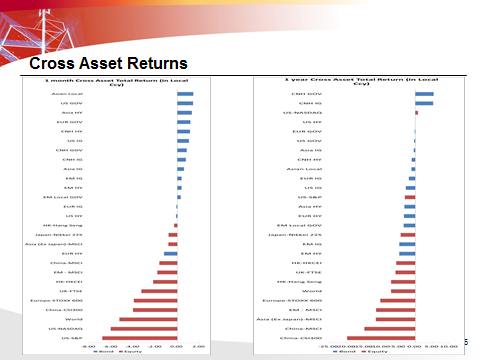

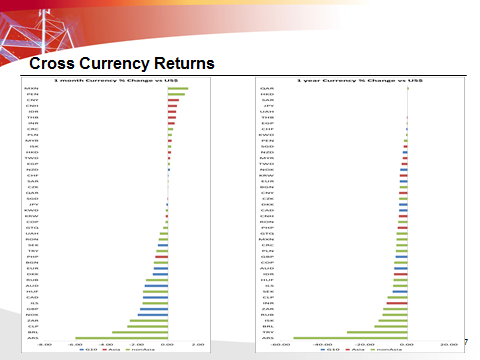

Here are the breakdowns of some cross asset returns and cross currency returns for 2018:

This clearly shows the rule of thumb withstands as risk is proportional to return.

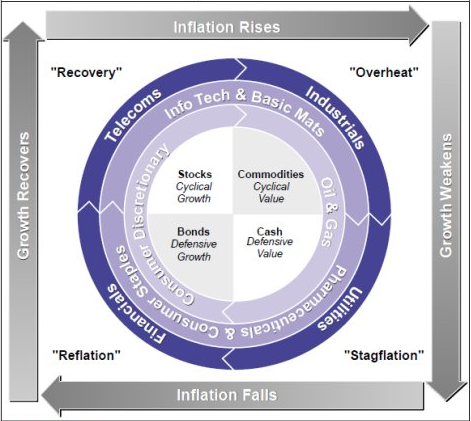

The Merrill Lynch Investment Clock

The “infamous” Merrill Lynch Investment Clock:

It’s a simple yet useful framework for understanding the various stages of a business cycle and which asset classes perform best in each stage.

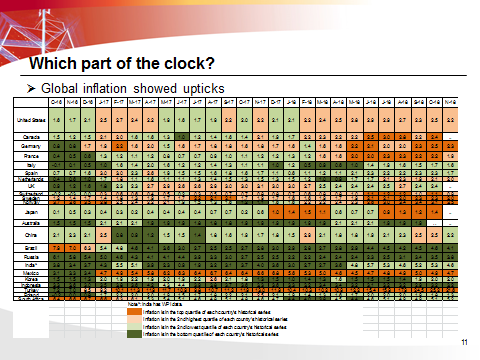

The Investment Clock splits the business cycle into four phases. Each phase is comprised of the direction of growth and inflation relative to their trends.

Here’s a breakdown of each phase.

Phase 1 – Reflation phase: Growth is sluggish and inflation is low. This phase occurs during the heart of a bear market. The economy is plagued by excess capacity and falling demand. This keeps commodity prices low and pulls down inflation. The yield curve steepens as the central bank lowers short-term rates in an attempt to stimulate growth and inflation. Bonds are the best asset class in this phase.

Phase 2 – Recovery phase: The central bank’s easing takes effect and begins driving growth to above the trend rate. Though growth picks up, inflation remains low because there’s still excess capacity. Rising growth and low inflation is the goldilocks phase of every cycle. Stocks are the best asset class in this phase.

Phase 3 – Overheat phase: Productivity growth slows and the GDP gap closes causing the economy to bump up against supply constraints. This causes inflation to rise. Rising inflation spurs the central bank to hikes rates. As a result, the yield curve begins flattening. With high growth and high inflation stocks still perform but not as well as in phase 2. Volatility returns as bond yields rise and stocks compete with higher yields for capital flows. In this phase, commodities are the best asset class.

Phase 4 – Stagflation phase: GDP growth slows but inflation remains high. Productivity dives and a wage-price spiral develops as companies raise prices to protect compressing margins. This goes on until there’s a sharp rise in unemployment which breaks the cycle. Central banks keep rates high until they reign in inflation. This causes the yield curve to invert. During this phase, cash is the best asset.[3]

The investment clock helps with understanding the progression of the economic cycle, as well as about preferable asset allocation for each relative phase. By theory, there should always be a safe spot.

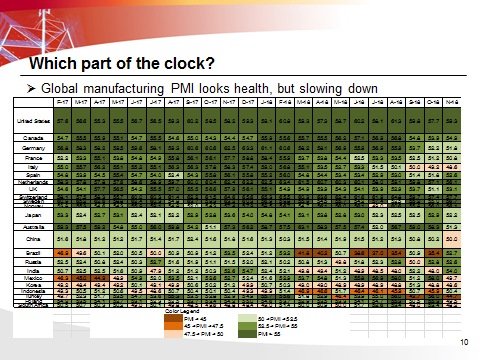

But as global market complexities increases and uncertainties arises, is it really the case?

Some Interesting Phenomenon in FICC

FICC stands for fixed-income, currency and commodities.

Fixed-Income markets are mostly OTC (over the counter), and have marketsizes that are much bigger than equity markets. Fixed-income market outperforms in the long run with stable return associated with relative lower risk.

Currency markets, some are traded in OTC, some in exchanges, but are moving to towards automation as banks cut human traders and expand auto trading platforms.

Commodity markets are traded in both Exchange and OTC.

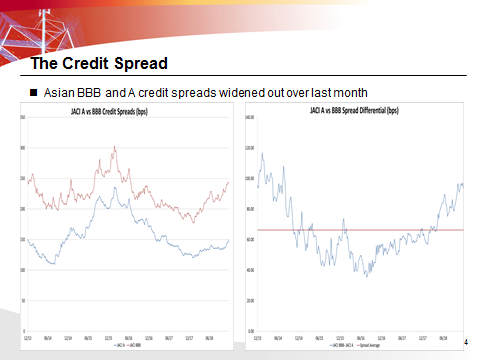

Some credit spread ideas, Asian BBB and A credit spreads widened out over the period of 2018. It may be more beneficiary to take on more credit and go down the credit curve.

Some Bond Arbitrage ideas, the same bond Issuer showing very evident spreads, this is a very clear cross border arbitrage.

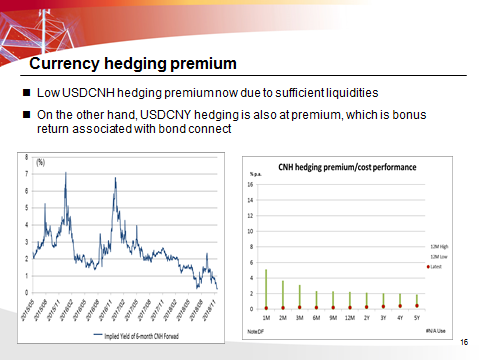

Some currency hedging ideas, USDCNH hedging is at relative low premium due to sufficient liquidities; on the other hand, USDCNY hedging is also at premium, which is bonus return associated with investment onshore from offshore.

References

[1].investopedia

[2].investopedia

[3].https://macro-ops.com/the-investment-clock/

[4].https://www.investopedia.com/articles/personal-finance/102015/series-b-c-funding-what-it-all-means-and-how-it-works.asp

[5].https://www.investopedia.com/ask/answers/05/debtcheaperthanequity.asp

[6].https://macro-ops.com/the-investment-clock/

本文系学生个人观点,不代表清华大学五道口金融学院及金融MBA教育中心立场,转载请联系作者授权。